Dependent Day Care Fsa Limits 2025

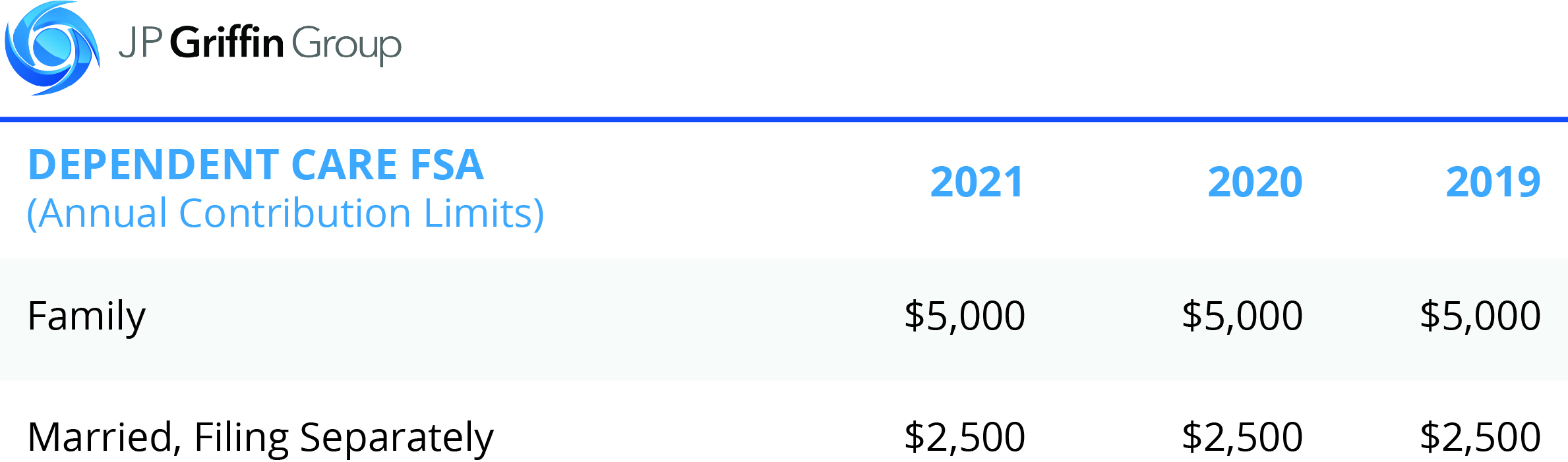

Dependent Day Care Fsa Limits 2025. Because of the american rescue plan signed into law in. The maximum annual contribution for a dependent care fsa — usually used for child or elder care — is $5,000 per household, or $2,500 if married and filing separately.

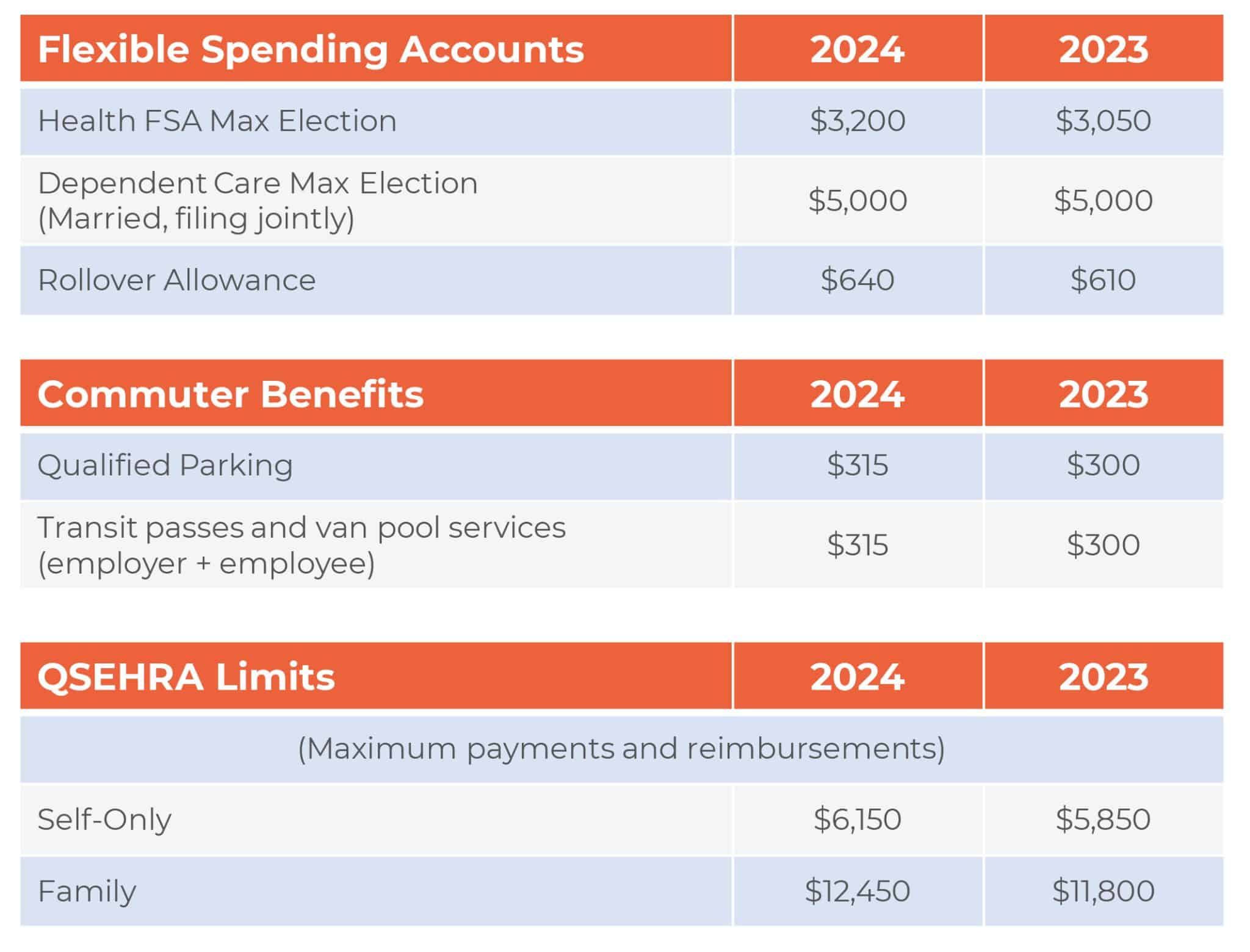

Irs 2025 fsa contribution limits. The minimum annual election for each fsa remains unchanged at $100.

If one spouse is considered a highly compensated employee (hce) (and has dependent care fsa contributions capped), and the other spouse (who works at a different company) is not, is the dependent care fsa contribution limit for married filing jointly still $5,000?

Fsa Limits 2025 Dependent Care Tera Abagail, $5,000 for single, unmarried individuals. But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Dependent Care Fsa Limit 2025 Covid Ericka Deeanne, Your dependent children under the age of 13. You may be able to claim the credit if you pay someone to care for your dependent who is under age 13 or for your spouse or dependent who isn't able to care for themselves.

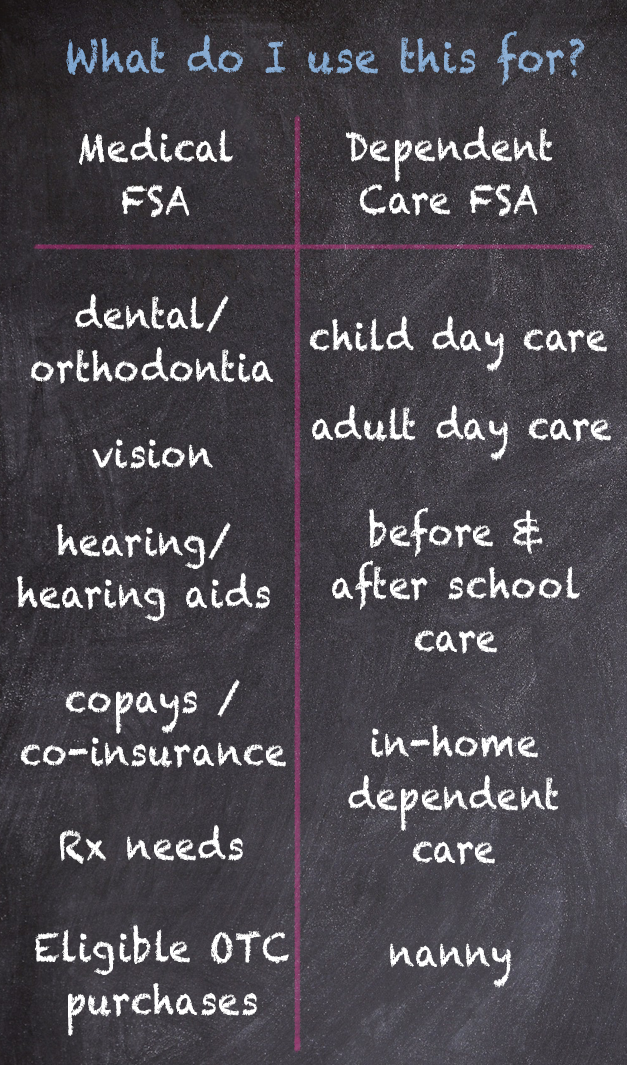

Irs Dependent Care Fsa 2025 Jayme Loralie, A qualifying ‘dependent’ may be a child under age 13, a disabled spouse, or an older parent in eldercare. It lets you set aside pretax dollars to pay for certain child and adult care services — services that allow you to work or look for work.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Unlike health care fsas which are indexed to cost of living adjustments, dependent care fsa contribution limits are not indexed for inflation and have been at this level for nearly 35 years, despite the rising costs of childcare. Find out if this type of fsa is right for you.

Tabela Atualizado Irs 2025 Hsa Imagesee vrogue.co, You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent. You can use the dependent care fsa to pay for the day care of:

Irs Fsa Max 2025 Joan Ronica, Irs fsa max 2025 joan ronica, dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing. You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent.

What Is The Maximum Hsa Contribution For 2025 Erica Ranique, $5,000 dependent care fsa calendar year limit The dependent care fsa limits are shown in the table below, based on filing status.

:max_bytes(150000):strip_icc():format(webp)/dependent-care-fsa_final-c8b6b245dc45448aa7538bb91a854bb8.png)

Dependent Care Flexible Spending Account (FSA) Benefits FAQs FSAFEDS, $5,000 for single, unmarried individuals. A dependent care fsa lets a household set aside up to $5,000 to pay child care expenses for kids under age 13.

Dependent Day Care Fsa Limits 2025 Clari Desiree, What is the 2025 dependent care fsa contribution limit? What is a dependent care flexible spending account?

Just In 2025 Benefit Limits HRPro, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. If you have young children, you already know that paying for child care can be.

A qualifying ‘dependent’ may be a child under age 13, a disabled spouse, or an older parent in eldercare.